Sort by:

-

![]()

Welcome to Your 529 Education Savings Benefit

Welcome to Your 529 Education Savings Benefit BlogPost 118885771558 Welcome to Your 529 Education Savings Benefit Use this step-by-step guide to get started We’re excited you’re here and ready to get set up with a 529! You can enroll in a new 529 plan, select plan-specific investments, connect existing 529 accounts, and automate payroll deductions all within the Betterment app. Use the step-by-step guide below to get started. Setting up a new 529 Get started Log in to your account, and choose: Add new goal. Click on 529 Plan. Answer a few questions about your savings goals. Choose your 529 plan Betterment will display one or more 529 plans you might be interested in based on your location, your beneficiary’s age, and any income tax benefits that may be available to you. You can pick one of those, or review all other options. If you choose a plan that can be integrated within the Betterment experience, you’ll move on to the steps below. Note that integrated 529 accounts and their plans are not managed by Betterment and instead are held and managed by program administrators of each 529 plan. If your selected plan is not eligible to integrate, you can still access and connect it to Betterment manually, and take advantage of Betterment’s other products alongside your education savings account. Select a portfolio Within each plan, there are two types of investment options: Choose a portfolio that’s managed for you by the plan investment manager and automatically adjusts over time. Choose to manage your own portfolio to reflect your time frame and desired risk level. This option gives you more direct control. Enroll in a plan Complete paperwork: Confirm details about yourself and any beneficiaries. All set! Check out your new goal in your Betterment dashboard! Connecting an existing 529 account Get started Log in to your account, and choose: Add new goal. Click on the 529 Goal. Click on Connect an existing 529 (If you choose a plan that can be integrated within the Betterment experience, you’ll move on to the steps below. Note that integrated 529 accounts and their plans are not managed by Betterment and instead are held and managed by program administrators of each 529 plan. If your selected plan is not eligible to integrate, you can still access and connect it to Betterment manually, and take advantage of Betterment’s other products alongside your education savings account.) Tell us your account number. Read and sign our Terms and Conditions. Authorize Betterment to access your account. In the Betterment app, you will now see your 529 plan in your dashboard. Set up contributions Navigate to set up contributions or deposits. You have two ways to contribute toward your 529 account: through payroll deductions or by linking a bank account within Betterment: Payroll deductions (post-tax): These payments are eligible for an employer match, if your employer offers one. Select Payroll deduction to have contributions automatically come out of your paycheck. Choose a 529 account to contribute to. Decide how much money you want to contribute per pay period. Review and approve your contribution rate. Linked bank account: Select Linked bank account Choose a 529 account to contribute to. Decide how much you want to contribute and at what frequency. Review and approve your contribution rate. Dashboard overview Overview tab: View all of your 529 accounts and balances. Note that payments typically take 5-7 days to process. Activity tab: See your Betterment payment activity. Settings tab: See your 529 account details and link your Betterment account directly to your 529 plan account in order to navigate back and forth seamlessly. -

![]()

Welcome to Student Loan Management by Betterment

Welcome to Student Loan Management by Betterment BlogPost 66884246540 Welcome to Student Loan Management Manage your student loans with this step-by-step guide. If your employer offers Student Loan Management, you can connect and view your student loans and make additional payments all within the Betterment app. Watch the demo video or follow the step-by-step guide below to get started. Connect your student loans Log in to your account and navigate to add a new account/goal. Click on the ‘Manage student loans' goal in order to start connecting your loan (see preview above). Click through and continue until you are able to identify your loan servicer. Enter your username and password in order to finalize connecting your loan. Click on ‘View my account’ in order to ensure you can see the new Student Loan Management goal. In order to connect additional loans, click on the ‘Connect new loan’ button on the top right corner and follow the instructions. Set up a recurring payment Navigate to the ‘Recurring payment’ section. Click on ‘Set up recurring payment.’ Similar to how you set up a contribution rate for your Betterment 401(k), decide on a percentage or dollar amount deduction from your paycheck to be contributed as an additional monthly payment toward your student loans (see preview below). If you are not eligible for a student loan match through your employer, you also have the option to set up your payments to be paid from a bank account. Identify which loan you’d like to have the recurring payment contribute toward. Betterment will provide you with an allocation recommendation here on which loan the payment will have the most impact towards. Set up a one-time payment Navigate to the ‘Make payment’ button and click on ‘Make a one-time payment.’ Follow the same instructions for setting up a payment as above. Dashboard overview Don’t forget to take advantage of all the resources available to you with the Student Loan Management tool. In the ‘Overview’ tab, you’ll be able to see your recurring payment, debt projections and payment history. If you are eligible for a match through your employer, you’ll be able to ensure you’re making progress against the eligible amount. In the ‘Loans’ tab, you will find a holistic overview of your connected student loans and financial advice from Betterment based on an analysis of interest rates and loan amounts. And lastly, in the ‘Settings’ tab, you will be able to customize your Student Loan Management goal. Here you will be able to change the picture, name or delete the goal entirely. -

![]()

How to pick a 401(k) contribution rate

How to pick a 401(k) contribution rate BlogPost 76295632789 How to pick a 401(k) contribution rate Your 401(k) contribution rate - also known as a deferral rate or savings rate - is a key part of a successful retirement strategy. You’ve taken that first step and have set up your Betterment 401(k) account - well done! One important piece to consider next is your contribution rate - how much from each paycheck will go into your account? With your Betterment 401(k), you could use a percentage or a fixed dollar amount, whichever you prefer. Here are a few other things to consider: Were you automatically enrolled? Many employers choose to automatically enroll their employees in the plan with a default contribution rate of 3% – if you're not sure, please check with your employer or take a look in your Retirement goal. Keep in mind, whatever the default contribution rate is, it’s just a starting point. You can (and probably should) increase that contribution rate at any time in your account. At least a decade without a paycheck Most experts recommend contributing 10%–15% of your paycheck to have enough to last you through retirement - which could be 20-30 years considering how long people are living! If you retire at age 65, with a healthy lifestyle and no major risk factors, you could live well into your 80s or 90s. That means you'll want to set yourself up for living off your personal savings and investments for about 20 years! Starting small is better than nothing If 10-15% of your paycheck sounds absurd to you right now - deep breath, think of that as something to aim for. You can start with something smaller, maybe 5 or 6%, and slowly but surely increase your savings rate every year – your birthday? Give yourself a gift and increase it by 1%. Your work anniversary? Cheers to you, bump it up again. And those 1% increases can actually be a big deal. Go for the max Because of its tax benefits, the IRS sets a limit on how much you can put into your 401(k) every year. So you could aim to contribute as much as the IRS allows! For people 50 and over, the limit is higher, which is referred to as “catch-up contributions.” And if you really want to be an over-achiever, you can also contribute to an IRA, an individual retirement account, to save even more. Tax considerations With your Betterment 401(k), you can make contributions into a traditional 401(k) account and/or a Roth 401(k). There are tax benefits to both: Traditional 401(k): Contributions are deducted from your paycheck before taxes are withheld, which can lower your taxable income. Both your contributions and investment earnings are “tax-deferred,” meaning you won’t pay taxes on what you contributed to the account as well as any earnings until you withdraw the money at retirement. In other words, save on taxes now, pay taxes later. Roth 401(k): Contributions are made with after-tax dollars so your withdrawals—both the contributions and earnings—are tax-free once you decide to retire (minimum age, 59½), and as long as you’ve held the Roth account for at least five years. In other words, pay taxes now, no taxes later. Remember that you can use both! Say you want to contribute 10% towards your retirement? You can put 5% into a traditional 401(k) and 5% into the Roth 401(k). This is one way you can balance your tax exposure. If you already have your account set up, log in today to adjust your contribution rate or reassess your traditional and Roth contributions. Haven’t started saving in your Betterment 401(k) yet? Check your email for an access link from Betterment, or get in touch: Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

When’s the best time to invest for retirement? Now.

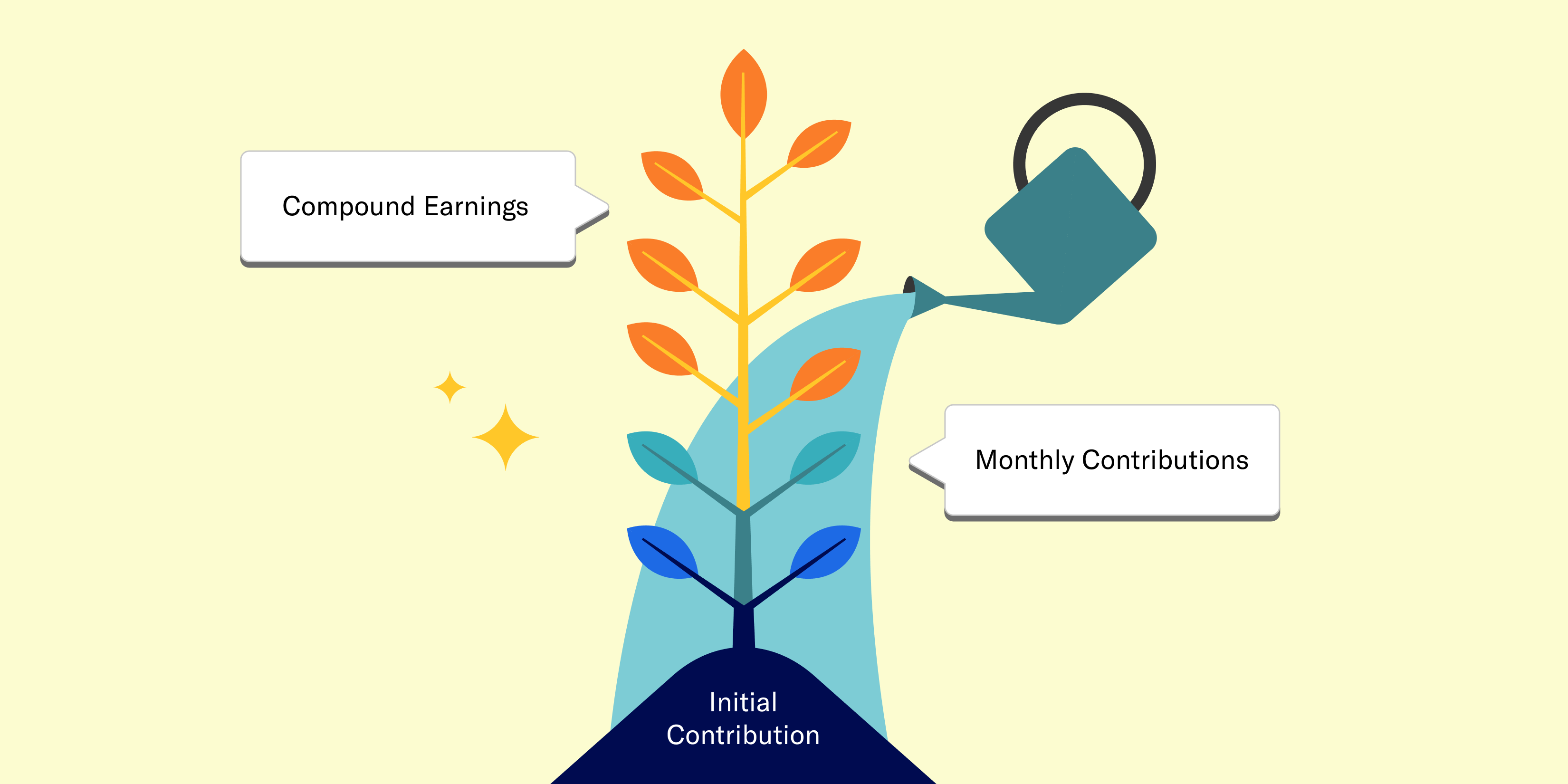

When’s the best time to invest for retirement? Now. BlogPost 76180127881 When’s the best time to invest for retirement? Now. | Betterment Should you start saving for retirement? Unless you are on one of those richest-people-in-the-world lists - then the answer is, most likely, yes. From paying the rent or mortgage, credit card bills, student loans, daily living expenses - there are a lot of things competing for your money’s attention! The idea of saving for retirement can easily be pushed to the backburner for all of those other - completely understandable! - reasons. But we’re here to say - hold the phone. Even a little bit into a 401(k) can make a huge difference for your retirement. Rock and roll When a rock rolls down a hill, it goes faster and faster on its way down. It has something to do with momentum and physics – we’re not scientists here, we’re investment professionals. But the same concept applies to your 401(k) - not because of physics, but because of compounding interest. Compounding interest means that not only are your original dollars growing based on potential stock market gains, but that newly earned money also grows whenever the stock market goes up! See how it works with this calculator tool. Give compounding time to shine If the magic of compounding interest isn’t enough to get you going right away, there is one other factor to consider. If someone starts saving 6% of their paycheck at age 25, they are expected to end up with more money at age 65 than someone who contributes 10% starting at age 40. And here’s the real kicker - the person who’s doing 10% starting at age 40 will put in more of their own dollars, and is still expected to end up with less by the time they reach age 65. How is that possible? The 6% contributions had more time to grow – more time to roll down that hill gathering speed – or in this case – money. If you already have an account, log in today to view your contribution rate and consider giving it a bump – even a 1% increase can make a difference in your retirement years! Haven’t started saving in your Betterment 401(k) yet? Check your email for an access link from Betterment, or get in touch: Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

Getting started with your Betterment 401(k)

Getting started with your Betterment 401(k) BlogPost 76288735864 Getting started with your Betterment 401(k) Your employer chose Betterment as its 401(k) provider - so come on in and be invested for your future. Traveling around the world. Taking up a new hobby. Spending more time with family and friends. Whatever your retirement dreams are, a 401(k) can help you make them a reality. And luckily for you, your employer chose Betterment to manage its 401(k) plan. Top 3 perks of a 401(k) Participating in your employer’s 401(k) plan is a good idea for many reasons – here are the top three. With a 401(k), you can: Contribute via convenient, automatic payroll deductions (one less thing to think about!). Save on taxes, whether those savings happen today with a traditional 401(k) or at retirement with a Roth 401(k) (and the cool thing is that you can use both!). Invest more than with other retirement vehicles (individual retirement accounts (IRAs) have lower caps on how much you can put in). All said, saving for retirement with a 401(k) is basically a no-brainer. Without a regular paycheck in retirement, you’re going to rely on your own savings. And we’re not talking about cash-under-the-mattress savings or even safe-in-the-bank savings - but invested savings, which is what you get with a 401(k). (Why is it so critical to invest for long-term goals, rather than simply saving money in the bank? To tackle one word: Inflation.) Top Betterment features Betterment offers several features to help you pursue your retirement goals: Goal based – Your 401(k) will automatically be a “Retirement” goal on the Betterment platform (you could add additional goals for other things if you want). Our goal-based platform looks at your timeline until retirement and the desired amount you want to save, to help you invest in an expert-built portfolio. Low cost – Our approach uses low-cost exchange-traded funds (ETFs) so more of your money stays invested in your account. High tech –Certain portfolio strategies and goal types are automatically rebalanced and adjusted over time, and our tax-smart tools are available to you at no added management fee. Personalized – Betterment helps you work towards your long- and short-term financial goals with personalized advice. It’s easy to get started Betterment will contact you via email to set up your account via a secure link that’s unique to you. If you haven’t received an invitation from us to set up your account, please contact us. Once you’ve set up your account, be sure to set a contribution rate to help you pursue your goals (although starting with anything is far better than nothing!) and you’ll want to initiate a rollover of any old 401(k)s into your new Betterment 401(k). Were you automatically enrolled in your plan? If so, you still need to set up your account with a username and password. If your employer has determined an automatic contribution rate for your organization, know that you can adjust this in your account at any time. Betterment strives to make saving and investing for retirement easy. But we know you still might have questions, so we’re here to help: Explore our 401(k) employee resources Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

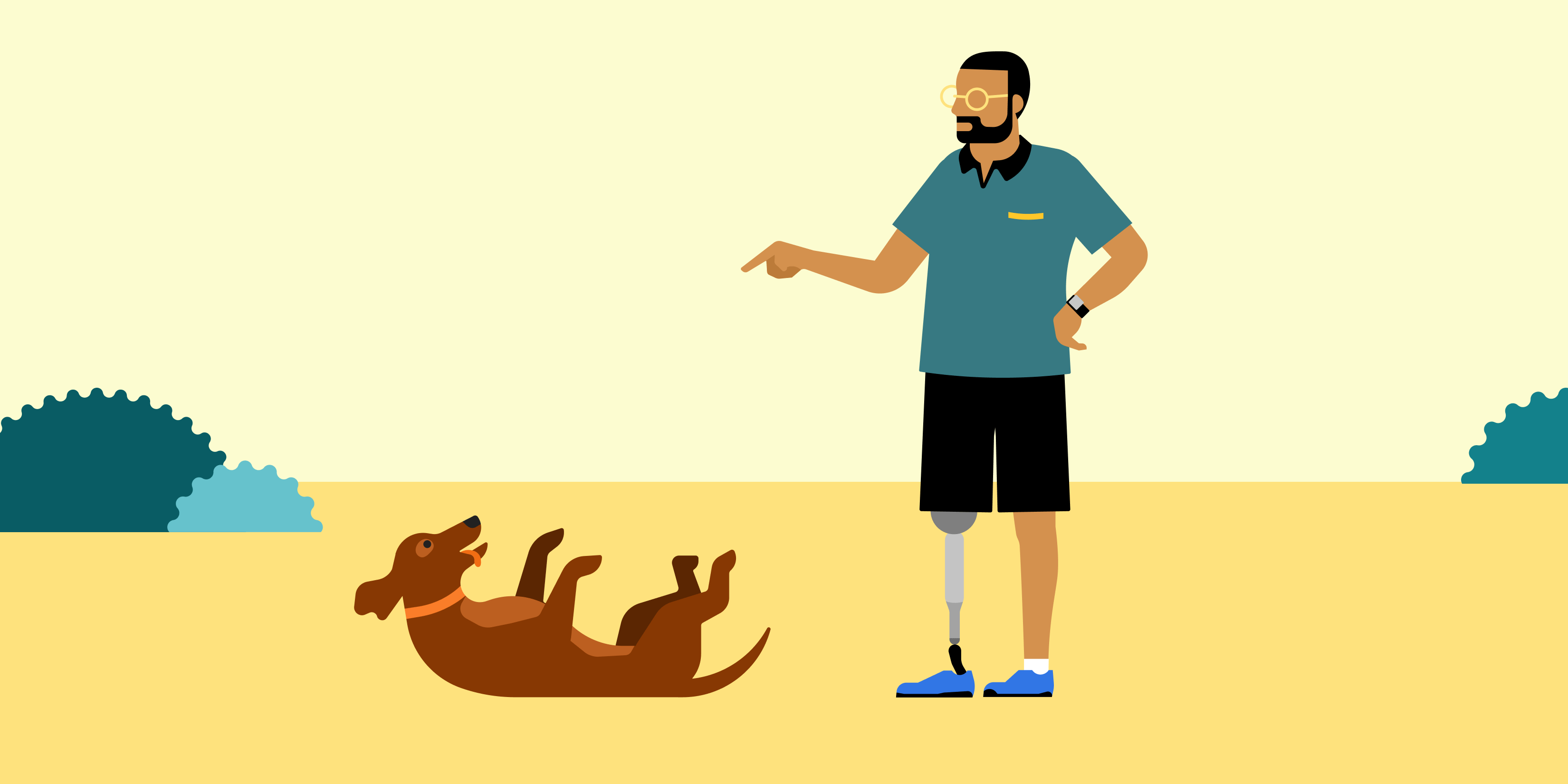

Rolling over is more than a dog trick

Rolling over is more than a dog trick BlogPost 76264698007 Rolling over is more than a dog trick Three reasons why rolling over 401(k)s from former employers may make sense. Have money sitting in 401(k) accounts from former employers? If so, you’re not alone. Recent research estimates that there are more than 24 million “forgotten” 401(k) accounts, holding approximately $1.35 trillion dollars. Are any of those dollars yours? If so, you should consider rolling any old 401(k) into your new Betterment 401(k) – here’s why: 1. Get a comprehensive view of your retirement savings When you have accounts here, there and anywhere, it’s hard to get a handle on where you stand. By rolling them over to your Betterment account and consolidating your retirement assets in one place, you can ensure your portfolio is appropriately diversified, monitor your progress, and rest assured that your investments aren’t competing or canceling each other out. 2. Avoid fees! Every 401(k) plan comes with fees. If you have multiple 401(k)s, you are paying fees for all of those accounts! Betterment has fees too –but we use low-cost exchange-traded funds (ETFs) in our portfolios, helping to keep fees low. 3. Access personalized financial advice and service Whether you want to talk investment strategy or review your retirement account, Betterment has CERTIFIED FINANCIAL PLANNER™ professionals and a customer support team that’s easy to reach when you need them. Your plan may include complimentary access to our team of CFPs® or you can book a call for a one-time fee. Other options Since you have access to a Betterment 401(k) through your employer, it could make sense for you to roll old 401(k)s into your Betterment 401(k) for all the reasons outlined above. But you do have other options: Leave it where it is. Roll it into an IRA (Individual Retirement Account), either with Betterment or another financial institution. Cash it out – this will come with taxes and potentially fees, and your money will no longer be invested (and potentially growing) for your retirement. Ready to roll? In just a few clicks, you can start the rollover process to Betterment and be set up with an appropriate investment strategy for you. You’ll receive a personalized set of rollover instructions via email, with no paperwork required by us. Have a different kind of account to roll over? No problem. You can roll over your IRAs, pensions, 401(a)s, 457(b)s, profit sharing plans, stock plans, and Thrift Savings Plans (TSPs) to Betterment using the same simple process. If you've already claimed your account, you can click here to start your rollover. If you have any questions along the way, our team is ready to help: Send us an email: support@betterment.com Give us a call: (718) 400-6898, Monday through Friday, 9:00am-6:00pm ET -

![]()

Why diversify outside of the US?

Why diversify outside of the US? BlogPost 70210330369 Why diversify outside of the US? The outperformance of US stocks in recent history has led some investors to question whether they should invest outside the US at all, yet there remains compelling reasons to diversify globally. US investors often think of the S&P 500 Index (an index of the largest companies in the US by market capitalization) when referring to the performance of the stock market. This is not surprising to hear as most US based investors exhibit a “home bias”, where they focus their investing domestically and less on international. In a Vanguard 2020 study, households they surveyed had 81% of their portfolio allocations invested in the US. On top of that, US stocks have set a high bar for performance globally, outpacing the gains in stocks across Europe, Japan, and emerging markets over the last decade. It’s become natural to ask, “Can’t I get better returns just sticking with US stocks? Why would my Betterment portfolio have any allocation to companies outside of the US?” Currently, Betterment’s Core portfolio strategy in the 100% stock allocation has a target allocation of more than 40% in international equities. Below, this piece will cover reasons diversifying internationally makes sense, including: The global market portfolio is a starting point for asset allocation There’s no guarantee that US stocks will continue to outperform Diversification creates the potential for more consistent returns Investing in the global market portfolio The short answer is that Betterment constructs all of our portfolios to be representative of the makeup of global investable assets as a whole, and you’ll find that around 40% of the world’s equity assets are invested outside of the US. International investments play an important role in reducing the risk of concentration in any one particular country within your portfolio. There’s no guarantee of continued US outperformance We’ve all heard the phrase “past performance is not indicative of future results.” For instance, stocks of one region can string together multiple years of outperformance relative to others before that trend reverses and it enters a period of underperformance. The chart below illustrates this tug of war between US and international developed stocks. While the outperformance experienced by US stocks over the last decade is striking, international developed stocks dominated in the wake of the dot com bubble in the decade before that. “International stocks” is represented by the MSCI EAFE Index. “US stocks” is represented by the MSCI US Index. Past performance is not indicative of future results. You cannot invest directly in the index. Going back further into history, in the ‘80s international developed stocks actually outperformed US stocks to the same extent that US stocks have outperformed since 2009. We believe, and many on Wall Street will admit, that trying to time these cycles can be extremely difficult and a more consistent return may be achieved by holding exposure to each geographical region’s stocks over the long-term. Before US stocks’ strong run in recent history, investors may have been tempted to allocate more to emerging market stocks based on their momentum during the 2000s. Emerging market stocks had higher returns than US equities in eight of the ten years before 2011. If an investor piled into emerging market stocks in 2011 because of their decade long track record of outperformance, they would have largely missed out on the strong gains in the US over the following 10 years. There also may be reason to believe that markets outside the US have the potential to post strong gains over the next decade. Based on certain valuation metrics, US stocks appear more expensive than their global peers. For example, companies in places such as emerging markets source much of their revenue from quickly growing economies, which may enhance profitability in the future. Diversification helps avoid drawdowns and creates the potential for consistent returns International markets are not perfectly correlated with the US, meaning they do not move in lockstep. Allocating to markets around the world therefore promotes diversification, helping buffer portfolios from the heightened volatility of individual markets. The chart below ranks the returns of Betterment’s tenured Core portfolio strategy against different regions and asset classes across calendar years, illustrating diversification in action. The Core portfolio, with a 90% allocation to stocks and 10% allocation to bonds, consistently avoided losses compared to the poorest performing assets of recent history. This was also evident in 2020 where diversification provided downside protection as the US fell into a short recession and battled a pandemic. Investors focused on using the S&P 500 Index to benchmark performance will highlight that the index outperformed our Core portfolio in the time periods displayed. And while the strength of the US market is undeniable, it is important to not overlook the fact that our Core portfolio still has a sizable allocation to the US. Having a strategic, well-diversified portfolio allows investors to obtain exposure to not only markets that outperform like the US, but also to international stock markets and other asset classes that can dampen the downside in years where US stocks underperform. S&P 500” (US Large Caps) is represented by the S&P 500 Index. “EM” (emerging markets) is represented by the MSCI Emerging Markets Index. “US Small Caps” is represented by the Russell 2000 Index. “EAFE” (international developed markets) is represented by the MSCI EAFE Index. “US REITs” is represented by the MSCI US REIT Index. “US High Yield” is represented by the Bloomberg US Corporate High Yield Index. “Global Agg bonds” is represented by the Bloomberg Barclays Global Aggregate Bond Index. “Commodities” is represented by the Bloomberg Commodity Index. “BMT Core 90/10” represents the Betterment Core Portfolio strategy in the 90% stocks/ 10% bonds taxable allocation. Performance information for the Betterment allocation is based on the time-weighted returns of Betterment taxable portfolios with primary tickers that are at the target allocation every market day (this assumes portfolios are rebalanced daily at market closing prices). Dividends are assumed to be reinvested in the fund from which the dividend was distributed. Betterment allocations reflect portfolio holdings as of periods stated and include an annual 0.25% management fee. This does not include deposits or withdrawals over the performance period. These allocations are not representative of the performance of any actual Betterment account and actual client experience may vary because of factors including, individual deposits and withdrawals, secondary tickers associated with tax loss harvesting, allowed portfolio drift, transactions that do not occur at close of day prices, and differences in holdings between IRA and taxable portfolios. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Market conditions can and will impact performance. Past performance is not indicative of future results. Market performance information is based on the returns of indexes tracked by Betterment, using returns data from sources and time periods listed. Performance is provided for illustrative purposes to represent broad market returns for asset classes that may not be used in all Betterment portfolios. The asset class performance is not attributable to any actual Betterment portfolio nor does it reflect any specific Betterment performance. As such, it is not net of any management fees. The performance of specific funds used for each asset class in the Betterment portfolio will differ from the performance of the broad market index returns reflected here. Past performance is not indicative of future results. You cannot invest directly in the index. At Betterment, we build portfolios and provide advice on portfolio allocations that should be suitable for each investor’s risk tolerance to help them reach their investment goals. Diversifying across stock markets, whether in the US or elsewhere in the world, helps in that continuous effort. It may be tempting to chase the high returns that US stocks have posted in recent history, anticipating that the US equity market will continue to outperform, but investors should recognize that future outperformance is near impossible to predict and that they should position themselves for a wide range of possible outcomes accordingly. This is why as a foundation of Betterment’s portfolio construction process, we start with a diversified global market portfolio. -

![]()

What is a Required Minimum Distribution?

What is a Required Minimum Distribution? BlogPost 56841935692 What is a Required Minimum Distribution? In exchange for all of the tax advantages 401(k)s provided during your accumulation years, by law, you will need to start taking distributions from your account when you turn 72. 401(k) plans can help you save for retirement in a tax-advantaged way. However, the Internal Revenue Service (IRS) requires that you start taking withdrawals from their qualified retirement accounts when you reach the age 72. These withdrawals are called required minimum distributions (RMDs). Why do I have to take RMDs? In exchange for the tax advantages you enjoy by contributing to your 401(k) plan, the IRS requests collection of taxes on these amounts when you turn 72. The IRS taxes RMDs as ordinary income, meaning withdrawals will count towards your total taxable income for the year. Generally, the IRS collects taxes on the gains in retirement accounts such as 401(k)s. However, if Roth 401(k) account assets are held for at least 5 years, Roth 401(k) funds are not taxed. Because there are taxes being paid to the government, these distributions are NOT eligible for rollover to another account. How much do I have to withdraw? RMDs are calculated based on your age and your account balance as of the end of the previous year. To determine the required distribution amount, Betterment divides your previous year’s ending account balance by your life expectancy factor (based on your age) from the IRS’ uniform lifetime table. If you had no balance at the end of the previous year, then your first RMD will not occur until the following year. Additionally, if you have taken a cash distribution from your 401(k) account in any given year you are subject to an RMD, and that distribution amount is equal to or greater than the RMD amount, that distribution will qualify as the required amount and no additional distribution is required. Does everyone who turns 72 need to take an RMD? Turning 72 in a given year doesn’t mean that you have to take an RMD. Only those who turn 72 in a given year AND meet any of the following criteria must take an RMD: You have taken an RMD in previous years. If so, then you must take an RMD by December 31 of every year. You own more than 5% of the company sponsoring the 401(k) plan. If so, then you must take an RMD by December 31 every year. You have left the company (terminated or retired) in the year you turned 72. If so, then the first RMD does not need to occur until April 1 (otherwise known as the Required Beginning Date) of the following year, but must occur consecutively by December 31 for every year. Example: John turned 72 on June 1, 2022. John also decided to leave his company on August 1, 2022. He has been continuously contributing to his 401(k) account for the past 5 years. The first RMD must occur by April 1, 2023. The next RMD must occur by December 31, 2023 and every year thereafter. You are a beneficiary or alternate payee of an account holder who meets the above criteria. If you are 72 and still employed, you do NOT need to take an RMD. What are the consequences of not taking an RMD? Failure to take an RMD for a given year will result in a penalty of 50% of the amount not taken on time by the IRS. How do I take an RMD? Betterment will automatically process your RMD if we see that you are over age 72 and no longer actively employed with your employer. If you have the option to take an RMD - age 72 but still employed - your employer can provide you with a form to submit a request. If you have a linked bank account on file, the RMD will be deposited into that account; if we do not have a bank account on file, a check will be mailed to the address in your account. -

![]()

Traditional and Roth 401(k)s

Traditional and Roth 401(k)s BlogPost 84944438566 Traditional and Roth 401(k)s Not sure what the difference is between traditional and Roth contributions for your 401(k)? We’ll explain. Ever hear the terms traditional 401(k) and Roth 401(k) thrown around and wonder – what are they? Should I be using them? Are these the keys to untold levels of wealth and financial security?! Easy does it. There are no secret weapons or silver bullets for securing a financially fit future. That said, traditional 401(k)s and Roth 401(k)s can be important tools when building your retirement strategy, so let’s make sure you know what they are. And a fun fact to know right away: you can use both. What do they have in common? A traditional 401(k) and Roth 401(k) are tax-advantaged accounts that allow you to save and invest for retirement (the tax advantages given to these types of accounts are not available in many other investing accounts). They’re available to you as a workplace benefit offered by your employer, and they’re funded with contributions from your paycheck – you set the amount, either as a dollar or a percent. The idea behind both is that they make it easier to save and invest for retirement automatically, like a built-in part of your budget. So what’s the difference? The difference is in how they are tax-advantaged. Traditional 401(k) contributions are made with pre-tax dollars, while Roth 401(k) contributions are made with after-tax dollars. Here’s an example. Let’s say you earn $40,000 a year and make contributions into a traditional 401(k). The contributions go into the account before your paycheck is taxed (“pre-tax”), lowering your taxable income. So if you save $3,000 throughout the year, you’d be paying taxes on $37,000 rather than $40,000. In addition, the money that you contribute—and any earnings—grow tax deferred until you withdraw it in retirement. At that time, your withdrawals are considered ordinary income and you’ll pay federal and possibly state taxes depending upon where you live. And, if you want to withdraw money before you turn age 59 ½, you’ll also be subject to a 10% penalty unless you qualify for an exception. If you decide to contribute to a Roth 401(k), the money is deducted from your paycheck after taxes have been taken out. So your paycheck is taxed now, reflecting your full salary of $40,000, which includes the contributions into the Roth 401(k) account. Roth 401(k) tax benefits come into play when you withdraw the money at retirement. Because you already paid taxes, you can withdraw contributions—and any earnings—tax-free if you’re age 59 ½ or older and have held your Roth 401(k) account for at least five years. Short answer: Traditional 401(k)s can lower your taxes now, but you’ll likely pay taxes when you withdraw the money at retirement. Roth 401(k)s don’t save you on taxes today, but you likely won’t have to pay taxes when you withdraw the money at retirement. Which type of account should I use? It ultimately depends on your unique financial situation and retirement goals. Betterment is not a tax advisor, and we encourage you to consult one if you want help reviewing your finances and goals. As a general rule: If you expect to be in a lower tax bracket in retirement, consider contributing pre-tax dollars into a traditional 401(k) account now, and you’ll pay taxes later. If you expect to be in a higher tax bracket in retirement, consider contributing after-tax dollars into a Roth 401(k) account, and pay your taxes now. What if I’m not sure if my tax bracket will be higher or lower in the future? You’re definitely not alone! In which case, it may make sense to invest in both. You’re allowed to make contributions to both types of accounts, spreading your tax exposure around. 5% in a traditional 401(k) and 5% in a Roth 401(k) would give you a 10% total contribution rate (in line with what many experts recommend). What if I want to withdraw my money early—that is, before I turn age 59 ½? Let’s start with the Roth 401(k). Because you already paid taxes on your contributions, you can generally withdraw that portion of the money tax-free. The portion of the withdrawal that represents your contributions to the account will generally be not taxed (and not subject to the 10% penalty). The portion of the withdrawal that represents earnings will be taxable and potentially subject to the 10% penalty. Most early withdrawals from a traditional 401(k) are taxed as ordinary income plus a 10% penalty. There are some exceptions, such as permanent disability. The tax advantages and ramifications of retirement accounts can be complicated. As Betterment is not a tax advisor, we encourage you to consult one to help you make this important decision. One more fun fact - former U.S. Senator from Delaware, William Roth, is the father of after-tax retirement accounts. Enjoy sharing that little bit of trivia at your next cocktail party, on us.